| September 2010 Index | Home Page |

Editor’s Note: As learning improves, it is also necessary to update the infrastructure to support teaching, learning, and business operations of the University. Intuitively we know that business operations are more accurate and less expensive using computers, but is this the right time to implement the computerized business plan? This research validates the change and discovers the driving forces behind the transition.

Usage of Self-Service Technologies (SSTs):

A Case Study of e-Debit System at Bursary UiTM Shah Alam

Fauziah Esman, Roslani Embi and Rohayati Jusoh

Malaysia

Abstract

This study examines the levels of intention to use the self-service technologies (SSTs), in particularly the ATMs and internet banking among the postgraduate students in the Universiti Teknologi Mara (UiTM), Shah Alam. Since 2006, the Bursary of UiTM has introduced the e-debit system to the students as a new way to settle the tuition fees. The objectives of the e-debit system are to reduce the human interaction between the bursary’s staffs and students, and the use of paper. In essence, the e-debit system consists of automated teller machines (ATMs), internet banking and cash transaction, but this study focuses on the usage of ATMs and online banking other than the cash transaction. Therefore, the research model proposed six variables, which are (a) perceived usefulness, (b) perceived ease of use, (c) perceived enjoyment (d) need for interaction, (e) security and privacy, and (f) demographic characteristics (such as gender, age, level of education, mode of study and faculty enrollment) for measuring the behavioral and intention to use the SSTs. Only 299 questionnaires were collected and this represents an 85.4% response rate. This study showed that the majority of the postgraduate students’ intention to use SSTs is at a moderate level. Statistical analysis revealed that perceived usefulness, perceived ease of use, perceived enjoyment, and security and privacy are the factors that affect students’ intention to use the SSTs. Furthermore, the results from stepwise multiple regressions demonstrate that perceived enjoyment is the best variable to predict students’ intention toward the usage of the SSTs.

Keywords: Self-service technologies, internet banking, e-debit system, perceived usefulness, perceived ease of use, perceived enjoyment, need for interaction, students’ intention, security and privacy

Introduction

Our daily lives have changed dramatically due to the technology revolution and we are getting used to technology-based services such as the internet, telephones, mobile phones and computers (Chau & Lai, 2003). Self-service technology (SST) refers to doing things by ourselves using technological devices with no interpersonal contact required between customer and service providers (Meuter et al., 2000). The SST may allow users to save time and expense in performing transactions (Polasik & Wisniewski, 2009). Many government departments around the world have adopted the internet as the primary means to deliver services to their citizens due to advantages such as electronic government or e-government. The ultimate goal of the e-government is to provide efficient and effective services to its citizens. In enhancing service quality, the Malaysian government has given the opportunity and freedom to all government departments to use its own creativity in implementing e-government. For example, the Bursary of Universiti Teknologi Mara (hereafter known as the Bursary), has made a step forward by introducing electronic payment to students in paying their tuition fees. Thus, this study used the bursary as a main source in order to determine the reliability and usefulness of e-debit as perceived by students. The University Teknologi Mara (UiTM) is well known for having a lot of campuses in Malaysia. Currently, the UiTM has 29 campuses and 124,117 students throughout Malaysia (Bursary, 2008). Thus, the Bursary is interested in adopting new technology in order to improve the tuition fee collection process. Consequently, the Bursary officially introduced ATMs and internet banking as an alternative mechanism for paying tuition fees since December, 2006.

Historically, prior to 1991, the method of payment was by cash to the bursary, money order, postal order or bank draft. The payment by cash created long queues in front of the Bursary’s counters. In order to solve this issue, in 1992, the Bursary engaged several banks to receive tuition fees. These are the Bank Simpanan Nasional (BSN), the Bank Muamalat, the Bank Commerce Berhad (BCB) and the Affin Bank. By using this system of payment, the Bursary would only have to generate bills and the faculty would distribute those bills to the students. However, this method created another problem if a bill was lost or misplaced before it reached the student or if a student misplaced a bill. Hence, in 2006, the Bursary set up collaboration with the Bank Islam Malaysia Berhad (BIMB) to introduce an electronic debit (e-debit) system in order to solve the problems created by misplaced bills. On top of that, the Bursary’s aim is to minimise human interaction and to reduce paper usage.

In the e-debit system, all transactions between students and the Bursary can be performed through internet connection. This transaction can be performed in four steps. First, the Bursary will generate the bills and upload them on the student portal. Second, students can access these bills online at any time, 24 hours a day for 7 days a week and at any place. Third, the BIMB will receive the students’ information from the Bursary in seconds after the bills generated. Fourth, students can settle their bills by giving their document number to any of the BIMB’s branches.

In Malaysia, there are very limited studies had done on the issues of the SSTs’ acceptance and adoption, in particular using the ATMs and internet banking. This issue, in some ways, has provided an avenue to this study to research the effectiveness of the e-debit system using ATMs and internet banking among UiTM’s students. Therefore the purposes of this study are to a) examine students’ intention on the usage of the self-service technologies (SSTs) such as ATMs and internet banking offered by the Bursary, b) to examine factors affecting the intentional use of SSTs and c) to examine factors that support use of SSTs.

Literature Review

Factors Influencing and Hindering Intentional Use of Self-Service Technology

Perceived Usefulness

Perceived usefulness (PU) is defined as “the degree to which a person believes that using a particular system would enhance his or her job performance” (Davis, 1989, p. 320). Ndubisi and Jantan (2003) defined perceived usefulness as the benefits derived from using a technology. It could be measured by increase in productivity, improvement in job performance, enhancement of job effectiveness as well as usefulness in the job. Previous studies in different countries showed that perceived usefulness was an important predictor of self-service technologies adoption (Wang et al., 2003; Pikkarainen et al.,2004; Curran & Meuter, 2005; Guriting & Ndubisi, 2006; Rigopoulus, 2007; Amin, 2007).

Perceived Ease of Use

Users are more likely to use a new technology if that technology is easy to use, user friendly and requires less effort to complete the tasks. Perceived ease of use (PEOU) was described as “the degree to which a person believes that using a particular system would be free of effort or freedom from difficulty” (Davis, 1989, p. 320). Meanwhile, Ndubisi and Jantan (2003) defined PEOU as a level of ease or difficulty in using a technology. A number of studies on the PEOU showed that PEOU was one of the determinant factors of system use particularly on the use of internet banking and ATMs (Wang, et al., 2003; Curran & Meuter, 2005; Park & Chen, 2007; Rigopoulos, 2007; Amin, 2007).

Perceived Enjoyment

Customers tendency to use the SSTs is supported by intrinsic motivation such as fun and enjoyment in using the technologies (Dabholkar, 1994). Perceived enjoyment (PE) is about the feeling of joy and pleasure, which emerges immediately from using the technology especially the computer and internet (Teo, 2001). Igbaria et al. (1996) explained that perceived enjoyment was an intrinsic motivation and users might be motivated to use new technology if they were able to obtain intrinsic psychological rewards. In addition, Heijden (2004) defined intrinsic motivation as fun that emerges from using the system. In terms of internet usage, PE (perceived enjoyment) had a positive relationship with internet usage (Teo, 2001; Zhang, 2004).

Demographic Characteristics

Previous studies found that internet usage, as a medium of online banking, associates with demographic characteristics such as gender, age and level of education (Teo, 2001; Chang & Samuel, 2004).

Security and Privacy

There is still a group of users who are reluctant to accept the self-service technologies due to security and privacy issues. Security and privacy risk referred to a possibility of the migration of personal information to the third parties without customers’ knowledge or permission (Sathye, 1999; Howcroft et al., 2002; Gerrard & Cunnigham, 2003; Zhao et al., 2008, Lee, 2009). The level of risk becomes high if there is no sufficient security and privacy guaranteed by the service providers especially banks. Hence, lack of security and privacy becomes a barrier in adopting internet banking.

Need for Interaction

Customers need to interact with bank employees in order to obtain sufficient information before making a decision. Thus, customers visit a branch bank to obtain sufficient information from the bank employees (Falvian, Guinaliu & Torres, 2006), users’ overall satisfaction (Haytko & Simmers, 2009), and customers who were uncomfortable, worried and anxious while using SSTs (Walker et al. 2002).

Technology Illiterate

A study done by Mols, Bukh and Nielsen (1999) revealed that customers were unwilling to use self-service technologies because they needed to access the internet in order to utilize the services and it was a hectic problem for those who were illiterate in internet and computer usage.

Research Model

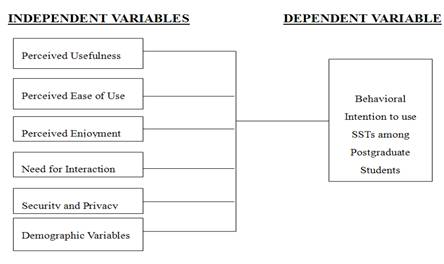

The research model is derived from combining various models in previous studies, which consist of perceived usefulness and perceived ease of use, perceived enjoyment, need for interaction, security and privacy, and demographic variables as independent variables, and behavioral intention to use SSTs is dependent variable (S.Wang, M.Wang, Ling & Tang, 2003; Shih & Fang, 2004; T.Pikkarainen et al.,2004; Curran & Meuter, 2005; Rigopolous, 2007).

Figure 2.1: Research Model of Behavioral Intention to Use Self-Service Technologies

Methodology

This study employed a self- administered survey questionnaire as a method for collecting data. Prior to distribution of questionnaires, the number of questionnaires to be distributed for every faculty’s areas, which are the Science and Technology, Social Science and Humanities, and Business and Management are determined based on proportionate stratified random sampling. The rationales of dividing 24 faculties into three (3) areas are to create clusters that have homogeneous groups and due to time constraint in collecting and distributing data. Currently, there are 24 faculty in UiTM and the total population of postgraduate students is 3,572 for the semester June/ December 2009.

Postgraduate students were selected as a sample due to their familiarity in using e-debit. A sample size is determined by using the Creative Research Software System. Three hundred and fifty students were selected from the population that based on 95% confidence level and 5% confidence interval. The questionnaires were divided into three-parts.

1. Part A has 25 questions about respondents’ perception on the SSTs. It can be further divided into five (5) factors, which are: (a) perceived usefulness, (b) perceived ease of use, (c) perceived enjoyment, (d) need for interaction, and (e) security and privacy.

2. Part B is comprised of five questions related to the behavioral intention of SSTs.

3. Part C is about the respondent’s background: (a) gender, (b) age, (c) level of education, (d) mode of study, and (f) faculty.

The questions were adapted from different sources based on previous research (S.Wang, M. Wang, Ling and Tang, 2003; Shih and Fang, 2004;T. Pikkarainen et al., 2004; Curran & Meuter, 2005; Rigopolous, 2007). From 350 questionnaires distributed to the respondents, 299 questionnaires were completed and returned. This is equivalent to an 85.43% response rate.

Data Analysis and Discussion

Descriptive statistics are employed in order to achieve thefirst research objective in which the respondents are asked five questions about the behavioral intention to use the SSTs. The total summed scores are calculated where the summed scores is used as an instrument rather than as a single-item score. Then, the total behavioral intention scores are separated into three categories which are; (a) 5.00-10.99, as lowest; (b) 11.00 -15.99, moderate level; and (c) 16.00-20.00 as the highest level of intention. Table 1 demonstrates the level of students’ intention to use self-service technologies.

Table 1

Scales of Score

Scores | Frequency | Percentage | Level of Intention |

5.00 - 10.99 | 6 | 2.00% | High |

11.00 – 15.99 | 189 | 63.21% | Moderate |

16.00 – 20.00 | 104 | 34.78% | Low |

299 | 100.00% |

Most of the postgraduate students that represent 189 questionnaires (63.22%) have moderate intention to use SSTs. Thus, one could assume that the level of intention in using SSTs among majority of postgraduate students in the UiTM, are at the moderate level. This could be due to the proportion of gender among postgraduate students that is slightly different from each other. The proportion of female (204) students is higher than male (95). This can be evident from the information tabulated in the Table 2.

Table 2

Students’ Intention to Use Self-Service Technologies by Gender

Gender | Mean | Frequency |

Female | 15.67 | 204 |

Male | 16.02 | 59 |

Total | 15.78 | 299 |

The mean scores for female students are 15.67 and male students are equal to 16.02. On top of that, this result is consistent with the works of Young (2000) and Nilsson (2007). Where, the authors revealed that males are more likely to use SSTs because they have a positive attitude toward the SSTs, high levels of confidence, greater computer skills and less anxiety compared to females.

In answering the second research objective, a T-test, One-way ANOVA and regression analysis are performed independently. The objective of these tests is to examine which independent variables (IV) are affecting students’ intention in using SSTs, in particular ATMs and internet banking, that is offered by the Bursary of UiTM. Independent T-tests are performed in examining whether gender, education level and mode of study, may in some ways, have significant effect on students’ intention to use SSTs. In addition, the One-way ANOVA was conducted to investigate the age categories. The rest of independent variables (IV) such as perceived usefulness, perceived ease of use, perceived enjoyment, need for interaction, and security and privacy are examined by a regression analysis.

As shown in Table 3, the result of T-test found that gender has no significant effect on the students’ intention to use the SSTs (p = .234, p > .05).

Table 3

Independent sample T-test of Gender

toward Intention to use SSTs

T-test for Equality of Means | |||

t | df | p | |

Equal Variances assumed | -1.191 | 297 | .234 |

This result is consistent with previous studies that reported gender did not play an important role in adoption of technology (Gefen & Starub, 1997; Maldifassi & Canessa, 2009). Another probable reason might be because students in UiTM, regardless of whether they are female or male, are more technology literate due to extensive efforts by UiTM to provide more facilities related to information, technology and communication. These sophisticated technologies gradually enhance student skills, experiences and perceptions of technology.

Table 4 showed that educational level (Masters or Ph.D.) is not significant in measuring the students’ intention to use the SSTs. This is evident in the p-value = 0.107 (p > 0.05). The possible explanations could be because both groups are categorized as possessing similar levels of education and SSTs such as ATMs and online banking are easy to use. Thus, differences in level of education are unimportant in determining their intention to use the SSTs.

Table 4

Independent sample T-test of Educational Level toward Intention to Use SSTs

T-test for Equality of Means | |||

t | df | p | |

Equal Variances assumed | -1.616 | 297 | .107 |

As shown in Table 5, p-value is equal to 0.459 (p > 0.05) and it signifies that mode of study is not a significant factor in students’ intention to use SSTs. One plausible explanation is that both groups (full-time and part-time) intend to use ATMs and online banking rather than cash in BIMB’s counter service to settle financial matters related to the Bursary. SSTs are very useful to students due to benefits offered. Hence, the difference in mode of study is not important.

Table 5

Independent sample T-test of Mode of Study toward Intention to Use SSTs

T-test for Equality of Means | |||

t | df | p | |

Equal Variances assumed | .741 | 297 | .459 |

Age is categorized into four categories (a) 20-29, (b) 30-39, (c) 40-49, and (d) above 50 years old. However, Czaja et al. (2006) categorized age into three main categories (a) 18-39, younger adult; (b) 40-49, as the middle adult; and (c) 60-91, older adult. Table 6 demonstrates that the p-value is 0.316 (p > 0.05). Thus, the result reveals that age is insignificant and not an integral factor that affecting students’ intention to use SSTs. The probable reasons are that most of the postgraduate students have intentions to use ATMs and internet banking in paying their fees and other financial matters is due to easy access and reduced processing time. In addition, facilities such as wireless internet and ATMs’ kiosk across the state campuses and Shah Alam also contributed to students’ intention to use SSTs. The result is consistent with the study done by Anandarajan, Simmers and Igbaria (2000) that age does not have any significant associations with the internet usage among postgraduate students at the university in the North-Eastern United States.

Table 6

ANOVA

Sum of Squares | df | Mean square | F | P | |

Between groups Within groups Total | 20.363 1691.069 1711.431 | 3 295 298 | 6.788 5.732 | 1.184 | .316 |

As shown in Table 7, perceived usefulness, perceived ease of use, perceived enjoyment, and security and privacy are significant due to p-values smaller than 0.05 and become the factors that affecting students’ intention to use the SSTs. One plausible reason is that most postgraduate students tend to use ATMs and internet banking if these SSTs enhance their job performance, are user-friendly, are less effort to use, and they feel joy and pleasure while using it. Also, there is minimal risk of third parties gaining access to their personal data without their permission. This is aligned with other previous studies (Wang et al., 2003; Pikkarainen et al., 2004; Curran & Meuter, 2005; Eriksson et al., 2005; Guriting & Ndubisi, 2006; Rigopolous, 2007; Amin, 2007) and contradicts the study by Ndubisi and Jantan (2003) that revealed the perceived ease of use did not have any significance in internet banking. In contrast, need for interaction is not significant as evidenced by the p-value equal to .994 (p > .05). The probable explanation is that the need for interaction with bank employees at the BIMB’s counter service is unimportant and it is considered as conducting cash payment method and involves a lot of time. This finding is consistent with the result of Curran and Meuter (2005), where they found that need for interaction has no significant effect on ATMs and online banking.

Table 7

Coefficients

Variables | Standard Coefficients | t | p |

Beta | |||

Perceived usefulness | .322 | 6.241 | .000 |

Perceived ease of use | .117 | 2.180 | .030 |

Perceived enjoyment | .283 | 5.167 | .000 |

Need for interaction | .000 | -.008 | .994 |

Security and privacy | .195 | 4.265 | .000 |

A stepwise multiple regression analysis was conducted in order to achieve the third research objective. Under this regression, only the significant results are shown, while insignificant variables are excluded. As shown in Table 8, four independent variables: perceived enjoyment, perceived usefulness, security and privacy, and perceived ease of use are the predictors that significantly predict the students’ intentions toward the use of SSTs, F(4,289) = 71.752, p = .000.

Table 8

Summary of Regression Analysis for Independent Variables

Sum of Squares | df | Mean Squares | F | p | |

Regression Residual Total | 842.940 848.792 1691.731 | 4 289 293 | 210.735 2.937 | 71.752 | .000 |

Predictors: Perceived enjoyment, perceived usefulness, security and privacy,

perceived ease of use

Dependent variable: Behavioral intention to use SSTs.

Meanwhile, in determining the best variable to predict students’ intentions to use SSTs, the columns of R square change and significant F change in Table 9 are noted. From the column of R square change, the highest percentage is considered as the best predictor. In addition, the column Sig. F change determines whether the variables are significant (p < 0.05).The results disclose that the behavioral intention to use SSTs is supported by perceived enjoyment at 34.5%, followed by perceived usefulness at 10.9%, security and privacy at 3.6% and perceived ease of use that less than 1%. Thus, it indicates that the perceived enjoyment is the best predictor to predict students’ intentions toward the use of SSTs. This might be due to the majority of the postgraduate students being in the age range between 20 and 39 years old. As the younger users, they are more exposed and enjoy using computer and internet. Thus, it can be easier for them to create a positive attitude on the system usage and eventually encourage them to adopt SSTs. The result is in line with the study of Heijden (2004) and Zhang (2004) that perceived enjoyment as a stronger predictor of behavioral intention than perceived usefulness.

Table 9

Variation Explained by Independent Variables

Step | R | Adjusted | R square Change | Sig. F Change | |

1 | .587a | .345 | .343 | .345 | .000 |

2 | .674b | .454 | .450 | .109 | .000 |

3 | .700c | .490 | .485 | .036 | .000 |

4 | .706d | .498 | .492 | .008 | .029 |

Predictors: (Constant), Perceived enjoyment

Predictors: (Constant), Perceived enjoyment, Perceived usefulnessPredictors: (Constant), Perceived enjoyment, Perceived usefulness, Security and Privacy

Predictors: (Constant), Perceived enjoyment, Perceived usefulness, Security and Privacy, Perceived ease of use

Conclusion

Overall, it can be concluded that postgraduate students are at the moderate level of intention in using SSTs. Most of postgraduate students are willing to use SSTs particularly ATMs and online banking because these technologies facilitate them in settling tuition fees and other financial matters. Perceived usefulness, perceived ease of use and perceived enjoyment become the factors to predict students’ intention in using SSTs and perceived enjoyment or the feel of pleasure and joy emerged from using ATMs and internet banking becomes the best predictor to predict students’ intention in using SSTs. From this result, we can see that the Bursary has to play an important role in encouraging students to use ATMs and internet banking in order to increase the highest level of students’ intention to use SSTs. One of the best solutions is by upgrading the e-debit system to become more user-friendly. This will encourage the non-adopters to use ATMs and internet banking rather than cash payment method, which need a lot of time queuing in bank. Additionally, campaigns on the advantages of using ATMs and internet banking should be carried out more frequently from one faculty to faculty or through the UiTM’s web site. Furthermore, during orientation week, a session on e-debit system can be organized to provide an overview about this system and its advantages. Most importantly, the clarification on the usage of ATMs and internet banking as an effective and convenient channel for settling fees and any financial matters should be taken as a priority. It hoped that with this extensive efforts and campaigns, students would prefer to use ATMs and online banking. Due to several advantages embedded in these technologies such as convenience, speed its transaction process and easy to use, students would not have to spend hours in the Bank and Bursary’s counter. Consequently, the Bursary’s aims to lessen human interaction will be achieved.

References

Amin, H. (2007). Internet banking adoption among young intellectuals. Journal of Internet Banking and Commerce, 12(3), 1-13.

Anandarajan, M., Simmers, C., & Igbaria, M. (2000). An exploratory investigation of the antecedents and impact of internet usage: An individual perspective. Behaviour & Information Technology, 19(1), 69-85.

Chang, J., & Samuel, N. (2004). Internet shoppers demographics and buying behaviour in Australia. The Journal of American Academy of Business, Cambridge (September), 171-176.

Chau, P.Y.K., & Lai, V.S.K. (2003). An empirical investigation of the determinants of user acceptance of internet banking. Journal of Organizational Computing and Electronic Commerce, 13 (2), 123-145.

Curran, J. M., & Meuter, M. L. (2005). Self-service technology adoption: comparing three technologies. Journal of Service Marketing, 19(2), 103-113.

Czaja, S. J., Charness, N., Fisk, A. D., Hertzog, C., Nair, S. N., Rogers, W. A., et al. (2006). Factors predicting the use of technology: Findings from the center for research and education on aging and technology enhancement. Psychology and Aging, 21(2), 333-352.

Dabholkar, P. A. (1994). Incorporating choice into an attitudinal framework: analyzing models of comparison processes. Journal of Consumer Research, 21(June), 100-118.

Davis, F. D. (1989). Perceived usefulness, perceived ease of use, and user acceptance of information technology. MIS Quartely (September), 319-338.

Eriksson, K., Kerem, K., & Nilsson, D. (2005). Customer acceptance of internet banking in Estonia. International Journal of Bank Marketing, 23(2), 200-216.

Flavian, C., Guinaliu, M., & Torres, E. (2006). How bricks and mortar attributes affect online banking adoption. International Journal of Bank Marketing, 24(6), 406-423.

Gefen, D., & Straub, D. W. (1997). Gender differences in the perception and use of e-mail: An extension to the technology acceptance model. MIS Quartely, December, 389-400.

Gerrard, P., & Cunningham, J. B. (2003). The diffusion of internet banking among Singapore consumers. International Journal of Bank Marketing, 21(1), 16-28.

Guriting, P., & Ndubisi, N. O. (2006). Borneo online banking: Evaluating consumer perceptions and behavioural intention. Managment Research News, 29(1/2), 6-15.

Haytko, D. L., & Simmers, C. S. (2009). What's your preference? An exploratory examination of the effect of human vs ATMS online interactions on overall satisfaction with banking services. Management Research News, 32(4), 2009.

Heijden, H. v. d. (2004). User acceptance of hedonic information system. MIS Quartely, 28(4), 695-704.

Howcroft, B., Hamilton, R., & Hewer, P. (2002). Consumer attitude and the usage and adoption of home-based banking in the United Kingdom. International Journal of Bank Marketing, 20(3), 111-121.

Igbaria, M., Parasuraman, S., & Baroudi, J. J. (1996). A motivational model of microcomputer usage. Journal of Management Information, 11(1), 127-143.

Lee, M. C. (2009). Factors influencing the adoption of internet banking: An integration of TAM and TPB with perceived risk and perceived benefits. Electronic Commerce Research and Applications, 8, 130-141.

Maldifassi, J. O., & Canessa, E. C. (2009). Information technology in Chile: How perceptions and use are related to age, gender, and social class. Technology in society, xxx, 1-14.

Meuter, M. L., Ostrom, A. L., Roundtree, R. I., & Binter, M. J. (2000). Self-service technologies: understanding customer satisfaction with technology-based service encounters. Journal of Marketing, 64, 50-64.

Mols, N. P., Bukh, P. N. D., & Nielsen, J. F. (1999). Distribution channel strategies in Danish retail banking. International Journal of Retail and Distribution Management, 27(1), 37-47.

Ndubisi, N. O., & Jantan, M. (2003). Evaluating IS usage in Malaysian small and medium sized firms using the technology acceptance model. Logistics Information Management, 16(6), 440-445.

Nilsson, D. (2007). A cross-cultural comparison of self-service technologies. European Journal of Marketing, 41(3/4), 367-381.

Park, Y., & Chen, J. V. (2007). Acceptance and adoption of the innovation use of smartphone. Industrial Management & Data Systems, 107(9), 1349-1365.

Pikkarainen, T., Pikkarainen, K., Karjaluoto, H., & Pahnila, S. (2004). Consumer acceptance of online banking: an extension of the technology acceptance model. Internet Research, 14(3), 224-235.

Polasik, M., & Wisniewski, T. P. (2009). Empirical analysis of internet banking adoption in Poland. International Journal of Bank Marketing, 27(1), 32-52.

Rigopoulos, G. (2007). A TAM framework to evaluate users' perception towards online electronic payments. Journal of Internet Banking and Commerce, 12(3), 1-6.

Sathye, M. (1999). Adoption of internet banking by Australian consumers: An empirical investigation. International Journal of Bank Marketing, 17(7), 324-334.

Teo, T. S. H. (2001). Demographic and motivation variables associated with internet usage activities. Internet Research: Electronic Networking Applications and Policy, 11(2), 125-137.

Walker, R. H., Lees, M. C., Hecker, R., & Francis, H. (2002). Technology-enabled service delivery: An investigation of reasons affecting customer adoption and rejection. International Journal of Service Industry Management, 13(1), 91-106.

Wang, Y. S., Wang, Y. M., Lin, H. H., & Tang, T. I. (2003). Determinants of user acceptance of internet banking. an empirical study. International Journal of Service Industry Management, 14(5), 501-519.

Young, B. J. (2000). Gender differences in student attitudes toward computers. Journal of Research on Computing in Education, 33(2), 204-215.

Zhang, Y. (2004). University students' usage and perceptions of the internet. Journal Educational Technology Systems, 32(2 & 3), 227-239.

Zhao, A. L., Hanmer, S., Ward, P., & Goode, M. M. H. (2008). Perceived risk and Chinese consumers' internet banking service adoption. International Journal of Bank Marketing, 26(7), 505-525.

About the Authors

Fauziah Esman is in the Commerce Department, Polytechnic Sultan Haji Ahmad Shah, Kuantan, Malaysia. Email: fauziah_polisas@yahoo.com

Roslani Embi is in the Faculty of Accountancy, Universiti Teknologi MARA, Shah Alam, Malaysia. Email: roslani-embi@yahoo.com

Rohayati Jusoh is in the Faculty of Accountancy, Universiti Teknologi MARA, Terengganu, Malaysia. Email: tie2878@yahoo.com